Spending trends

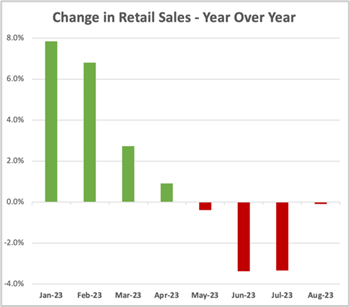

Consumer spending on credit and debit cards accelerated 6.8% in August 2023 over August 2022. At a macro level, that’s healthy spending growth above inflation of 3.7%, but many retailers are not benefitting. Retail spending was down slightly at -0.1%, which is a significant decline in real terms.

Lower spending at gas stations (-4.2%) due to lower gas prices is a small part of the story, but discretionary spending is the bigger driver. Furniture stores (-19%), home décor stores (-18.2%), electronics stores (-8.7%), liquor stores (-8.4%), home improvement stores (-7.7%), and fashion retailers (-5%) all saw steep declines. Consumers spent more of their discretionary dollars outside of retail. Entertainment spending jumped 15.6%. Fitness (+5%), Media (+4.8%) and Travel (+3.2%) all grew as well.

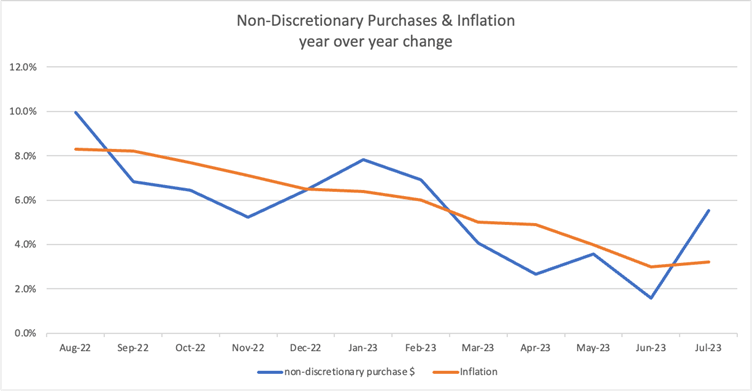

As one would expect, non-discretionary purchases are still rising year over year and have tracked inflation (see following chart). They are by definition required purchases where consumers have little choice but to absorb higher prices. Rent and housing costs have risen significantly too as noted by the WSJ, further eating into consumers budget for optional purchases.

Within non-discretionary spending, August card sales increased at Mass merchants (+5.4%), Warehouse clubs (4.6%) and Grocery stores (+1.4%). But merchants in these categories such as Walmart and Target have noted in their earnings call that sales of discretionary items are lagging.

Marketing implications

With shrinking discretionary spending budgets, what’s a marketer in discretionary categories to do? For starters, don’t be a leaf in a stream. Many companies will tighten budgets and try to ride out this cycle. When others cut spending, that’s an opportunity for you to increase your share of voice and market share. Defend your budget and fight for an increase next year. While driving a sales increase may be tough, frame your potential impact as the difference between advertising and doing nothing – AKA incremental sales. Advertising that is proven to drive sales is hard to ignore, especially ads with short payback periods.

Now may not be the right time to develop a new branding campaign. Consider instead how you can sharpen the targeting of your lower funnel ads to the people most likely to buy. Doing so will reduce the investment required to move the sales needle while growing your return on ad spend. Sharper targeting can be achieved through audiences of likely recent buyers, competitive buyers, lapsed buyers, or heavy buyers rather than an attitudinal or demographic segment. Purchase based audiences cut unnecessarily wasted reach with people who likely don’t buy your category.

In your creative, keep the broader economic climate in mind. You are competing for a share of the consumers wallet, not just against your direct replacements. Try more emotion, more promotion and any other appropriate -tions. But seriously, have some fun. Be different. Stand out. Breaking through the clutter AND being compelling is a great combination for winning marketing and driving sales.

Looking Ahead

Although the recent retail sales trends (see nearby chart) are not encouraging for the holiday shopping season, consumers may shift their priorities from travel and experiences to gift giving. Our holiday forecast will be released by mid-October and will include breakdowns by discretionary and non-discretionary spending. Stay tuned.

About Commerce Signals

We help marketers understand their customers and competition, grow sales, and prove their business impact. Our purchase-based audiences, campaign measurement and customer insights are powered by the largest consumer payments data sets which includes Visa and Mastercard, credit and debit card spending. Contact us for customized recommendations on how we can help with your biggest challenges.