The numbers are in and 2021 consumer holiday spending did not disappoint. In fact, 2021 holiday sales knocked many analysts’ projections out of the water. U.S. consumer spending on credit and debit cards from the week of Thanksgiving through the week of Christmas 2021 was up a mammoth 22% according to Commerce Signals Consumer Spend Tracker.

As to be expected, some sectors did better than others. The categories that saw skyrocketing sales during the 2021 holiday season were those that customers missed out on the most during coronavirus shutdowns. Travel, restaurants, apparel and in-store shopping all saw big jumps, which are detailed below.

The 2021 Holiday Shopping Mindset

There were a lot of warnings being issued before the 2021 holiday season. Supply chain slowdowns were expected to impact the availability of many product categories. Additionally, the postal service was expecting delays after being completely bombarded during the peak of the pandemic in 2020. Everyone from retailers to government officials cautioned customers to buy and send their gifts early, so their family and friends would get them in time for the holiday season.

Consumers were optimistic after the first round of vaccines, when it looked like the world –– and the economy –– was going to return to normal. But the first U.S. case of the omicron variant appeared in the U.S. on December 1st, which noticeably impacted some categories.

Let’s take a deeper look at our 2021 holiday season sales data, the patterns that emerged and what they mean for future sales.

A Return to Travel

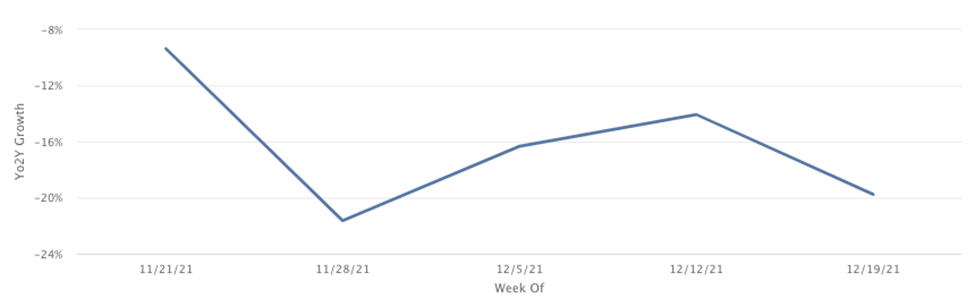

There was definitely pent up demand for personal travel after enduring 2020 when people were encouraged not to travel or get together with family and friends. The travel sector as a whole saw a +139% YoY increase. But it started even hotter, with black Friday week up 152%. In fact, that first week of the holiday season saw consumer travel spending nearly 5% above 2019. The omicron news tamped down that acceleration during the rest of December.

Airlines saw the biggest boost with a +182% jump over last year. Hotels were up +123% and auto rentals were also up +62% YoY. Comparing airline bookings to 2019 shows the clearest impact of renewed consumer travel fears. The week after thanksgiving dropped significantly (see chart below).

Retail Shopping

While it’s true that many consumers wanted to spend on experiences rather than things, they also wanted to look good while doing it. The apparel sector saw the biggest boom under the retail umbrella. Clothing store and department store purchases were up 29% and 26% respectively as customers clamored to pick up new ensembles.

Retail as a whole saw a welcome +10.6% sales boost YoY. Consumers used some of their savings from a year lived indoors to make more online (+4.2%) and instore (+15.4%) purchases. The week of Christmas was the busiest time for retail holiday spending with purchases up 25.5%.

Thankfully, this spending growth was not entirely due to price inflation. Purchase transactions were up +7.7% during the 2021 holiday season. We saw an average ticket boost of +2.8%. Interestingly, the average ticket of online purchases (+5.9%) exceeded that of in-store purchases (+1.6%).

Dining Out

Consumer spending at restaurants and bars was up a very healthy 54.4% despite many restaurants struggling to find staffing. On-premise dining was up nearly 69% with takeout and delivery up 16%.

In Summary

When viewing data from the 2021 holiday season, it’s important to keep in mind that the purchasing landscape of the 2021 holiday was an anomaly on multiple levels. From the influx of government money into society, low unemployment, a very low 2020 base year and a return to normal, many factors contributed to drive overall spending up 22%. While we are always happy to see strong consumer spending, we can only hope that the exact environment that created the holiday shopping boom won’t be replicated in our lifetimes.

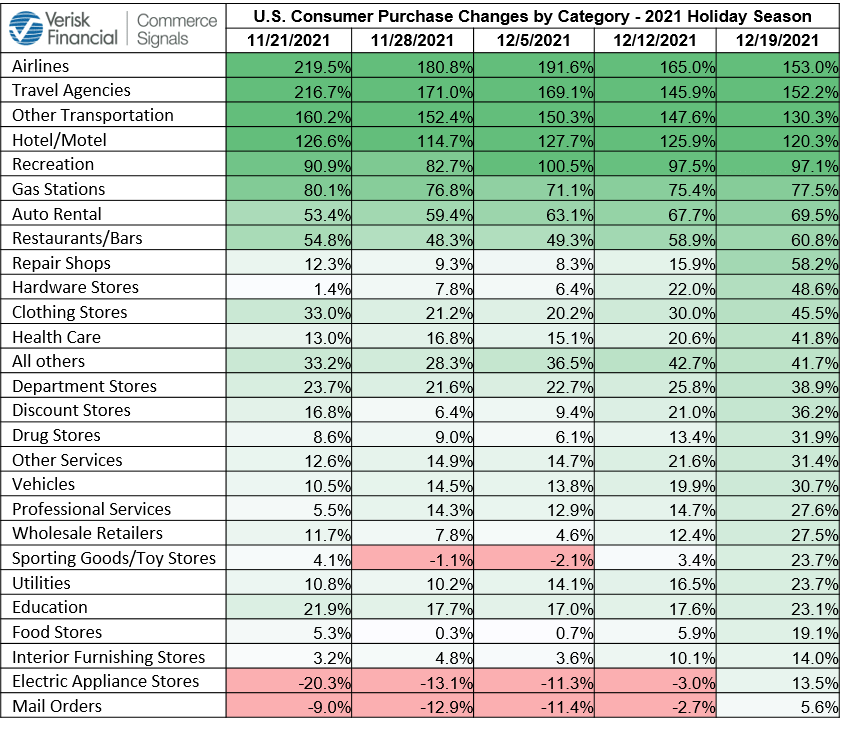

With that said, there’s plenty we can learn from 2021 shopping data. Here’s the full breakdown of weekly YoY growth by category during the holidays.

About the Data in This Article

All data in this article is from Commerce Signals, a TransUnion company. With a permissioned and anonymized view of consumer credit and debit card spending behavior, Commerce Signals’ powerful insights, accurate audiences and campaign measurement help eliminate waste and boost marketing ROI. Its solutions are used by some of the largest retailers, direct to consumer and adtech companies in the country.

This article originally appeared in The Robin Report