The week of Christmas 2020 looked a lot different than 2019. The coronavirus pandemic and government recommendations not to travel or gather with friends and family put a damper on traditions. Covid-19’s rapid spread impacted consumer spending patterns as well. Consumer spending on credit and debit cards was up 7% during Christmas week, although the continued shift from cash to card makes the overall spending picture look a bit rosier than it is for brick and mortar businesses.

Channel preference shifted drastically

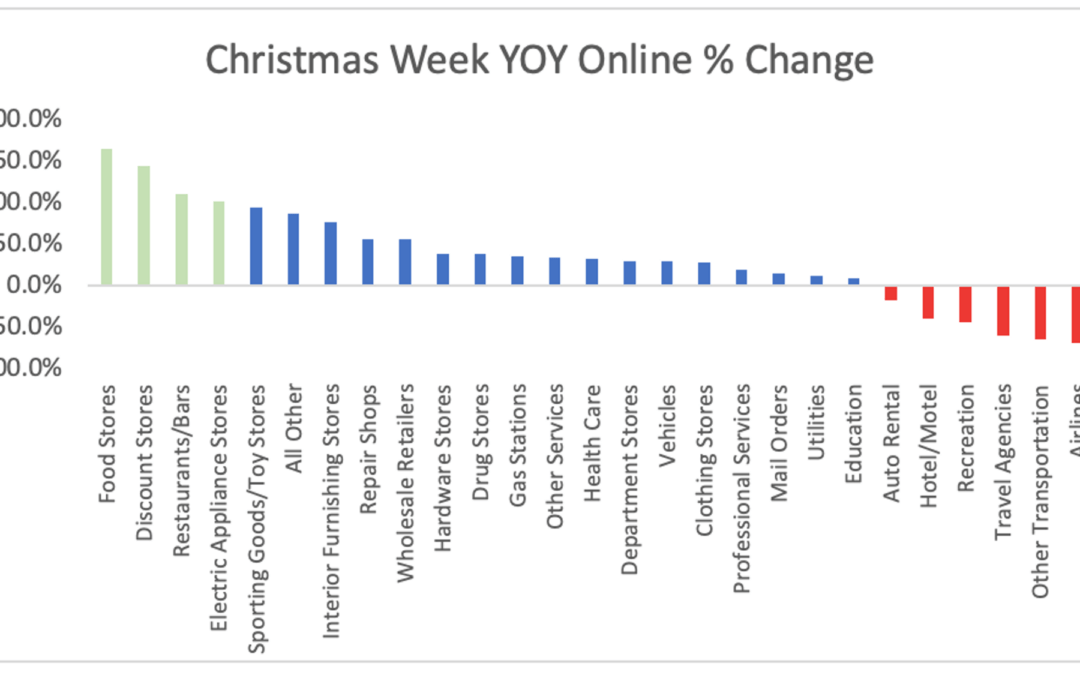

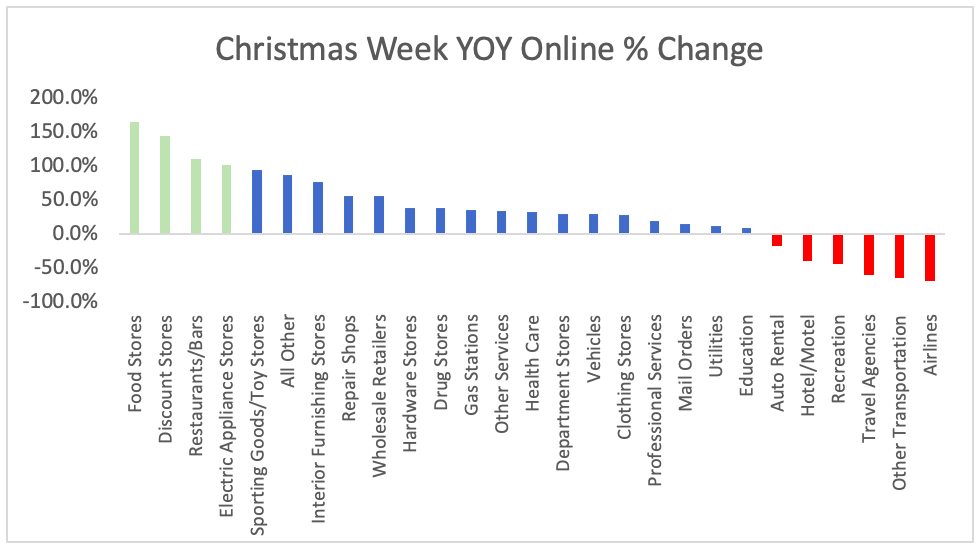

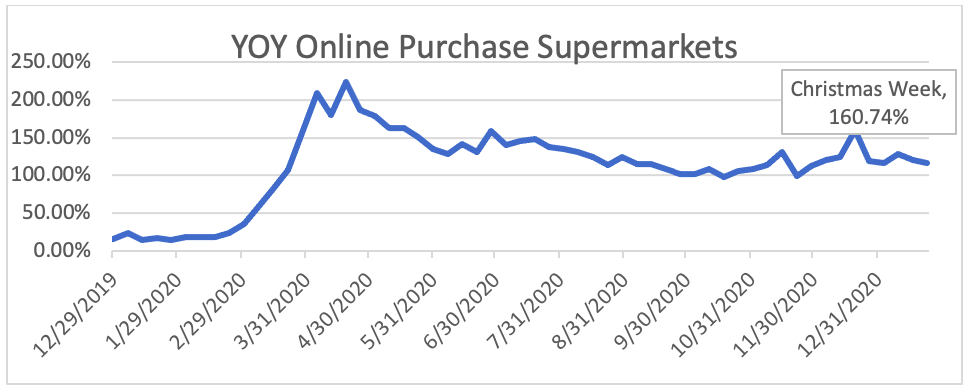

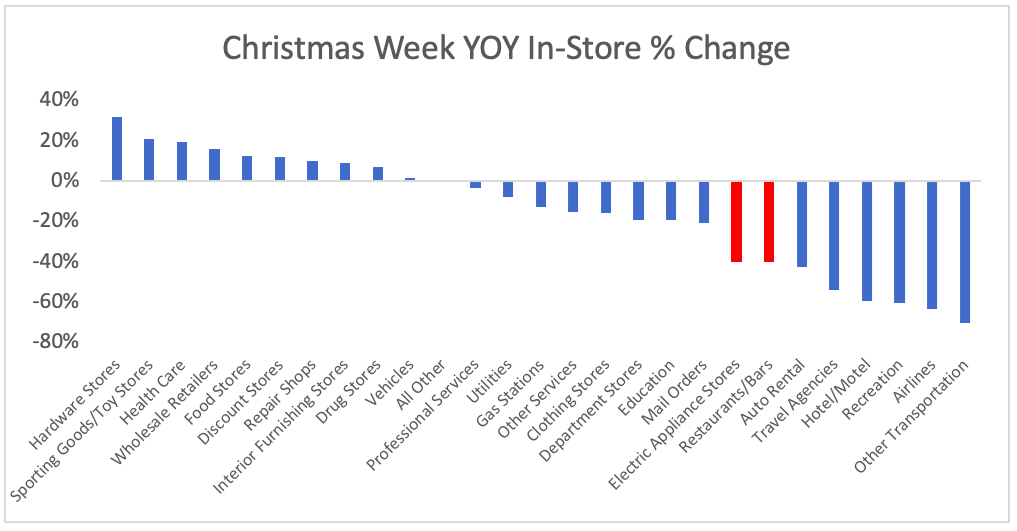

Online sales for Christmas week increased by 25% while in-store sales grew by only 5%. Online sales more than doubled in Grocery, Mass Discounters, Restaurants, and Electronics stores. Unfortunately for restaurants, that growth still wasn’t enough to offset declines on premise. Travel related categories saw no relief from recent sales trends both online and overall.

While online Grocery YOY sales have consistently up all year, Christmas week still spiked with the highest growth since April.

In-store sales showed a very different picture with most categories down vs 2019. Outside of travel, Electric appliances and Restaurants/Bars were impacted the most.

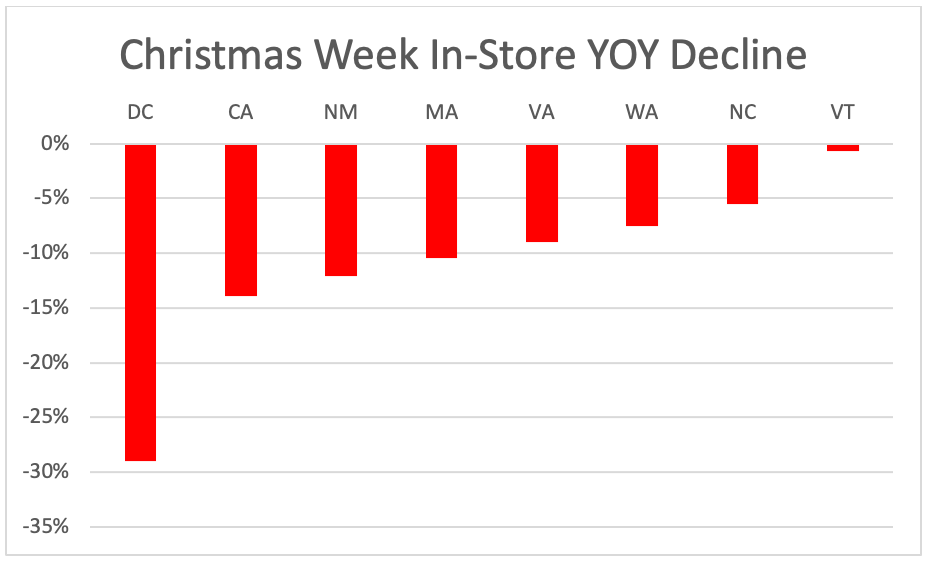

However, even during this pandemic, not all states saw in-store sales decline. Consumer spending behavior at stores varied significantly based on region. Local government regulations had a huge impact on spending patterns too. States with stricter covid restrictions had an average of -7% decline in YOY Sales, whereas states that were more lenient had a 1% growth in sales. States with the strictest regulations per wallethub unsurprisingly saw in-store sales decline the most.

Stay On Top Of Consumer Spending Trends

For weekly updates on consumer spending by category, state/county, online and offline, check out the Commerce Signals Consumer Spend Impact Tracker. All of the data in this article is pulled from it. The dataset is refreshed weekly.